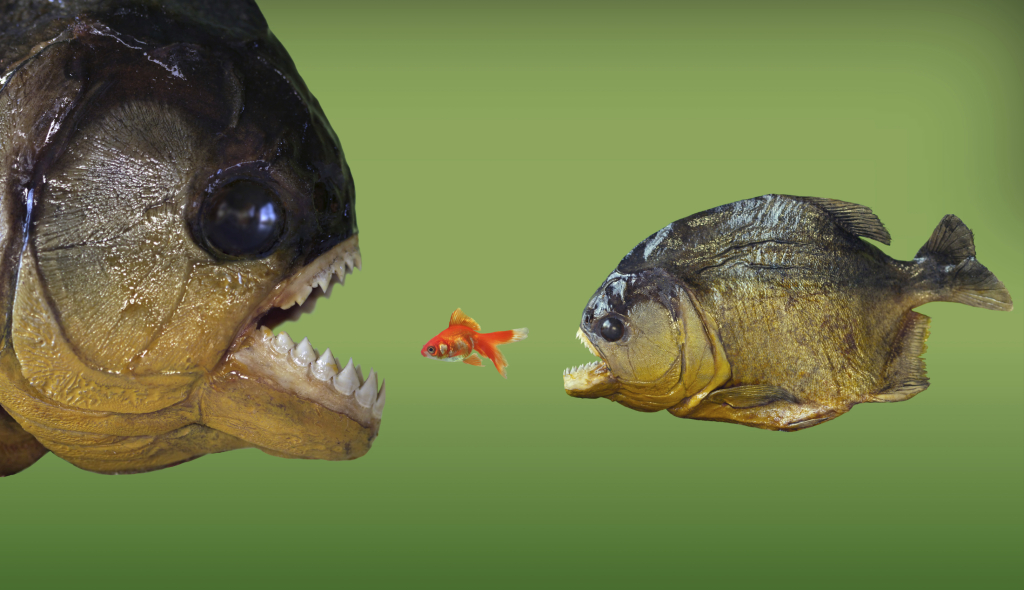

In the world of junk debt buying all debt buyers are not created equal. The big guys like Midland Funding, Portfolio Recovery Associates, and Cavalry SPV file hundreds of thousands of debt collection lawsuits per year. However, there are much smaller companies that also file debt collection lawsuits in large numbers and you may find yourself in their cross-hairs.

In the world of junk debt buying all debt buyers are not created equal. The big guys like Midland Funding, Portfolio Recovery Associates, and Cavalry SPV file hundreds of thousands of debt collection lawsuits per year. However, there are much smaller companies that also file debt collection lawsuits in large numbers and you may find yourself in their cross-hairs.

Here in Arizona some of the smaller debt buyers are companies like Copper State Financial Management, Trento, LLC, Alco Capital Group, and The Todd Company, LLC. While it is just as stressful to get sued by a smaller debt buyer there is reason to be optimistic – the smaller the debt buyer often the easier it is to prevail in your case. Here’s why…

Debt Buyers Like Copper State Financial Management Pay Less for the Debt They Purchase

The big players like Midland Funding generally get first shot at buying the most collectible debt. If they don’t or can’t collect on the accounts they purchase they will package them and sell them to another junk debt buyer. Sometimes old charged-off debt accounts will change hands several times before a debt buyer finally files a lawsuit.

Each time the debt trades hands the new buyer pays less for the accounts – which is saying something because companies like Midland Funding pay as little as 4 cents on the dollar for the debt they purchase. It is not uncommon for smaller debt buyers to pay less than a cent on the dollar for debt.

Smaller Debt Buyers Have Less Evidence to Prove their Case

Because smaller debt buyers like Copper State Financial Management pay less for the accounts they purchase, and because the debt has changed hands so many times, a lot gets lost along the way.

And this is a problem for the debt buyer.

Because not only does the debt buyer have to prove that you had an account with the original creditor but they have to show a chain-of-title proving that they own the account. They have to prove that they own the debt and show with valid, admissible evidence that each company that bought the debt from the original creditor on down actually transferred (sold) the debt to the next creditor.

The more times it changes hands the less documentation you seem to get – resulting in an chain-of-title that is incomplete, broken. And if they can’t prove that they own the debt you win the case.

If you find your self being sued by Copper State Financial Management , Alco Capital Group, Trento, LLC, or even The Todd Company, know that you have more than a decent shot of winning your case – make the debt buyer prove it.

Need More Information on How to Deal with Debt Buyer Lawsuits? Check out my Latest Webinar!

Click HERE to access the recorded video webinar.

Schedule a Free Consultation!

John Skiba, Esq.

John Skiba, Esq.

We offer a free consultation to discuss your debt problem and help you put together a game plan to eliminate your debt once and for all. Give us a call at (480) 420-4028