Most people that will read this article have had the unpleasant experience of receiving a knock at the door only to get served with a lawsuit. After the shock subsides as to what just happened, you look at the paperwork and you ask yourself the question: “who in the world is Midland Funding and why are they suing me?”

Most people that will read this article have had the unpleasant experience of receiving a knock at the door only to get served with a lawsuit. After the shock subsides as to what just happened, you look at the paperwork and you ask yourself the question: “who in the world is Midland Funding and why are they suing me?”

First, Midland Funding is one of several companies that buy debts for pennies on the dollar and then sues folks like you. The kicker is, you may or may not actually owe this debt and they may or may not be able to prove it! You need to understand who is suing you, why you are being sued, and what you can do about it.

Failing to educate yourself about this situation you suddenly find yourself in will likely result in a judgment against you. After they get a judgment you will see your wages get garnished and your bank accounts drained. While you may be new to the legal process, the company suing certainly is not.

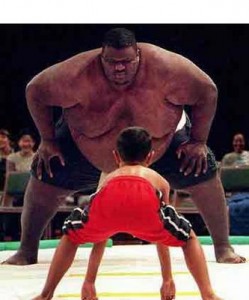

”The creditors are all repeat players. They know exactly how the game works,” said Elizabeth Warren, a Harvard Law School professor who studies consumer debt. ”We’re watching a fight between two players, one a skilled repeat gladiator, and one who’s thrown into the ring for the first time and gets clubbed over the head before they even get a sense of what the rules are.” (Debtor’s Hell, The Boston Globe).

Let’s start with who is suing you…

The Debt Buyers

The Debt Buyers are companies that that purchase debts, such as credit card debts, from the original creditor and then seek to collect them. The Debt Buyers can make money doing this because they pay very little for the debts. One major debt buyer paid under 2 cents a dollar for debt involving California, Arizona, and Florida (National Consumer Law Center, Collection Actions, §1.4.1. (2d ed. 2011)). For a

$5,000 debt, that means this debt buyer paid $100 – meaning anything over $100

they get out of you is profit!

You likely got sued by one of the largest debt buyers. They are:

- Sherman Financial Group

- Unifund

- Asset Acceptance Corp.

- Firstcity Financial

- Encore Capital Group

- Portfolio Recovery Associates

- Asta Funding

- Midland Funding

Why You are Being Sued

As mentioned above, one of these Debt Buyers purchased a debt that you allegedly owed to a totally different creditor. For instance, let’s say you owed a debt to Chase bank for a credit card you may have had previously. Now, one of the Debt Buyers is alleging that they now own this debt and want to get paid. The way they figure they will get paid is by suing you.

Why You Should Fight

Approximately 90% of law suits by Debt Buyers result in a default judgment. A default judgment means that the person being sued did not respond any manner to the law suit and the court gave them everything the Debt Buyer was asking for. And the Debt Buyers are filing suit in huge numbers. In 2008 one Debt Buyer, Encore Capital Group, filed 450,000 law suits around the country!

So, why should you fight Debt Buyer law suits? Because many times there are defenses available that will result in you winning the law suit. Debt Buyers often buy very old debts, and because of this many times the statute of limitations has expired.

Further, many times the Debt Buyer does not have sufficient evidence to prove their case. Remember, because they are the Plaintiff it is their burden to not only prove that you owe the debt but also that they own the debt. Frequently they can’t prove that they own the debt they are suing you resulting in a dismissal of the case. And sometimes they are simply suing the wrong person.

In times past there may have been an assumption or expectation that if a person was sued that they certainly owed the debt. With the explosion of debt buying companies and questionable law suits that are filed by these companies’ expectations and assumptions must change.

If you have been sued by a Debt Buyer you need to understand the process and what you are facing. I would be happy to meet with you and help you put together a game plan to best defend you and your property. I can be reached at (480) 420-4028 or via email at john@skibalaw.com.

*Please note, I am licensed to practice law in Arizona and cannot provide legal advice or represent parties that have been sued in a state other than Arizona.

Schedule a Free Consultation!

John Skiba, Esq.

John Skiba, Esq.

We offer a free consultation to discuss your debt problem and help you put together a game plan to eliminate your debt once and for all. Give us a call at (480) 420-4028