Midland Funding continues to flood Arizona courts with debt collection lawsuits filed against Arizona consumers. Last year I pulled the data in October 2015 as to the number of lawsuits filed by junk debt buyers like Midland Funding here in Maricopa County and the numbers were astounding – nearly 3,000 debt collection lawsuits filed in a single month!

The interesting (and tragic) thing about junk debt buyer lawsuits is that they impact so many families here in Arizona yet there surprisingly few people understand the magnitude of the problem and even more surprising there are very few lawyers who help consumers battle these giant debt collection companies.

The Reason Why I Fight Back Against Midland Funding

Of the handful of attorneys that represent Arizona consumers against junk debt buyers like Midland Funding the Arizona Consumer Law Group is a leader when it comes to protecting consumer’s rights.

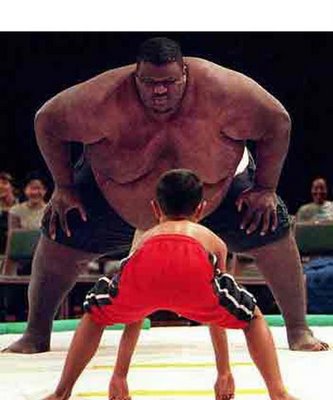

It is vital to a well functioning judicial system that both sides get a fair opportunity to be heard. If one side gets too much power then everyone’s rights are at risk.

Think of this in the context of the criminal justice system. If defendants accused of a crime never had an attorney representing them, but there was always a criminal prosecutor representing the State of Arizona, you can see how easily the system would get out of whack and the rights of the defendants would become almost non-existent.

We have a similar situation right now here in Arizona when in comes to consumer debt cases (particularly junk debt buyer cases) in the Arizona court system. 95%+ of these cases end in a default judgment – meaning that the defendant (i.e., you) did not file a written response to the lawsuit.

The other 5% where the consumer does fight back are usually handled on a “pro per” basis, meaning the defendant is representing themselves in court. Only a very small percentage of the consumers are represented by a lawyer.

The Court Will Not Assert Your Rights for You

Many people represent themselves because they believe that they can simply tell their side of the story to the court and the judge will make sure that all of the rules are followed.

However, in a civil case debt collection case the judge is there to determine whether you are liable for the debt or not. If Midland Funding (or any other debt buyer) is not following the Rules of Procedure of the Rules of Evidence then the court is going to leave it up to you to raise the objection. If you don’t the court his unlikely to step in and assert your rights for you.

This is why so many consumers get railroaded when they go to trial. They don’t know the rules and are unfamiliar with the civil court process while the attorney for Midland Funding is very familiar with the rules and process and use it to their advantage.

For most, they show up to court on the day of trial and before they know it the case is over and judgment has been entered against them. They leave feeling that the system is rigged and they didn’t get a fair shake.

Why You Should Fight Back Against Midland Funding

If you have been sued by Midland Funding you have many strong defenses that you can present to the court as to why you shouldn’t be required to pay them a dime.

Think about it, Midland Funding didn’t loan you any money and you didn’t agree to pay them any money so why should you be required to write them a check? Unless they can prove with admissible evidence that you had an account with the original creditor and that Midland Funding actually owns that specific account you shouldn’t be required to pay them anything.

Here at the Arizona Consumer Law Group our attorneys have dedicated their careers to helping consumers fight back against abusive debt collectors like Midland Funding and even offer a free consultation where we can review your case and help you to understand your options. If you need assistance feel free to contact us at (480) 420-4028 or email me at john@skibalaw.com.

Schedule a Free Consultation!

John Skiba, Esq.

John Skiba, Esq.

We offer a free consultation to discuss your debt problem and help you put together a game plan to eliminate your debt once and for all. Give us a call at (480) 420-4028