I am proud to announce the launch of the Consumer Warrior Forums. Every day I get emails, comments on my blog, phone calls, and meet with people in person who are desperate for help with their debt collection lawsuit but either can’t afford an attorney or it doesn’t make sense to hire an attorney because the amount in dispute is less than what it would cost to hire a lawyer.

I am proud to announce the launch of the Consumer Warrior Forums. Every day I get emails, comments on my blog, phone calls, and meet with people in person who are desperate for help with their debt collection lawsuit but either can’t afford an attorney or it doesn’t make sense to hire an attorney because the amount in dispute is less than what it would cost to hire a lawyer.

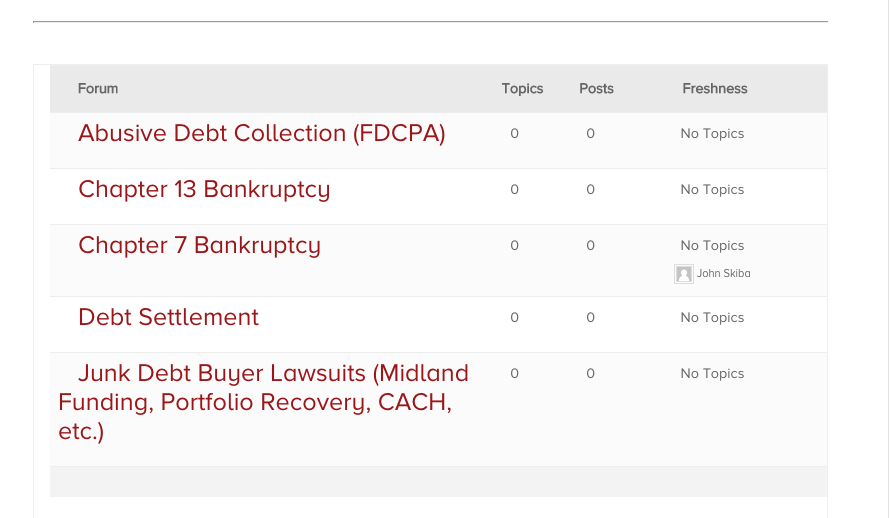

The Consumer Warrior Forums is a place where consumers can go to ask questions and discuss issues related to debt collection lawsuits, bankruptcy, debt settlement, FDCPA / Abusive Creditor Claims, and student loan issues. I will personally be participating in the forums and my hope is that as the number of participants grow that people can share ideas and strategies for dealing with debt problems.

Here is a screenshot of the topics currently available for discussion:

Participation in the forums is absolutely free. You can register and start posting questions immediately by clicking HERE.

It is important to note that while I can’t give specific legal advice on the forum I can provide you with resources and legal information that can help you in dealing with your debt problem. My hope is that others are willing to share tips and some of their experiences in fighting back against abusive creditors.

Check it out and let me know what you think!

Consumer Warrior Forums

My Theory on Why Midland Funding is Filing So Many Lawsuits for Under $1,000

There has been a trend over the last few months for junk debt buyers like Midland Funding to file lawsuits against consumers for relatively low amounts – many times on balances that are less than $1,000. On its face its doesn’t seem to make sense that Midland Funding would take the time, effort, and money to file a debt collection lawsuit when the most they could get would be under $1,000. However, I have a theory as to why they would file such a low dollar lawsuit – Midland is aware that financially it doesn’t make sense for a consumer to hire an attorney to defend against the lawsuit and thus they are likely to end up obtaining more default judgments and for those who do respond to the lawsuit Midland will likely not have to face an attorney on the other side.

Schedule a Free Consultation!

John Skiba, Esq.

John Skiba, Esq.

We offer a free consultation to discuss your debt problem and help you put together a game plan to eliminate your debt once and for all. Give us a call at (480) 420-4028