Sometimes bankruptcy is necessary, but the process does little to solve the underlying reasons people find themselves in overwhelming debt problems.

Financial Coaching can help you to get out of debt, avoid bankruptcy, and obtain vital skills necessary to personal financial management and wealth building.

– John Skiba, Esq.

Attorney & Certified Ramsey Solutions Master Financial Coach

Debt Elimination

Budgeting Skills

Paying for College

Wealth Building

Charitable Giving

Retirement Planning

Ready to Get Started?

This approach to getting out of debt isn’t complicated, but it is going to take effort and determination.

If you are truly ready to make a lasting change – if you are sick and tired of being sick and tired – let’s do this. Click below to get started.

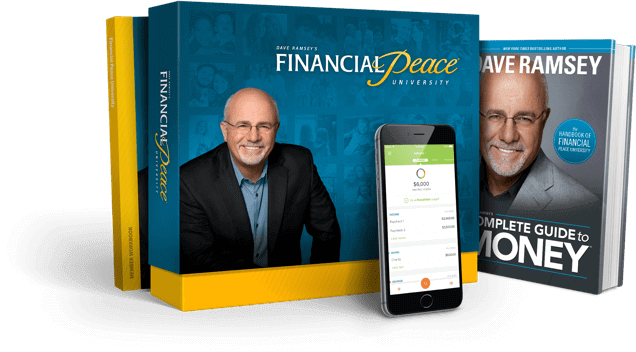

All new Financial Coaching clients receive FREE enrollment in Dave Ramsey’s Financial Peace University, including immediate access to Financial Peace Univerity online video lessons, tools, and resources, the Financial Peace University member workbook, and Dave’s best-selling book “The Complete Guide to Money” – a $149 value!

Is Financial Coaching Right for You?

What is Financial Coaching?

Financial coaching is the process of learning new strategies and skills to tackling your debt and creating a solid foundation for your financial future.

John Skiba, Esq. is in the unique position of being a license consumer protection attorney with vast experience in helping clients navigate the legal system, and being a certified Ramsey Solutions Master Financial Coach.

John’s skills as an attorney and a Master Financial Coach will be used to provide you with all of your options as well as a sound understanding of the consequences and benefits.

What Can I Expect from Coaching Sessions?

Coaching sessions are typically scheduled for one (1) hour and are focused on providing you with the knowledge, skills, and motivation you need to take control of your finances once and for all.

Prior to each session, Mr. Skiba will gather information about your current financial situation and what you hope to achieve our sessions, whether that be debt elimination, budgeting skills, or wealth building.

During the coaching session, you will discuss in depth the problems you are trying to overcome, strategies and solutions to solving the problem, and action items that you will take with you begin making the necessary changes.

Later, Mr. Skiba will provide you with my written analysis of your situation and the agreed-upon action items.

Follow up sessions can be scheduled at the time of the first session or at your convenience.

Do I Need to Live in Arizona for Financial Coaching?

I help clients with Financial Coaching services from around the country. While I am only licensed to practice law in the State of Arizona, Financial Coaching services are not considered legal services and thus I can assist anyone who needs assistance and motivation in getting out of debt and gaining financial independence.

Coaching sessions can take place online or over the phone.

How Much Does Financial Coaching Cost?

One (1) hour coaching sessions are $175. You also have the option of choosing 3 coaching sessions at the price of $400.

Financial Coaching isn’t inexpensive, however, when compared to bankruptcy ($2,000+) and debt settlement companies, Financial Coaching provides high value and teaches you skills and strategies that will benefit you for a lifetime.

Why the Dave Ramsey Approach to Debt Elimination?

You may be thinking “what is a bankruptcy lawyer doing encouraging clients to eliminate debt by implementing Dave Ramsey’s approach?”

Here’s the thing…I have helped clients through the bankruptcy process for nearly 15 years. I know the process inside and out, the pros and the cons. I also know that bankruptcy is absolutely necessary in some cases.

However, after years of meeting with families day-in-and-day-out, I know that bankruptcy is not only not necessary in many situations, but can be downright harmful.

Also, I have found that while bankruptcy can eliminate debt very quickly, people often don’t learn the skills necessary to not only avoid bankruptcy again but thrive financially.

Financial skills like monthly budgeting, saving, investing, and charitable giving. These skills are often not taught in the home and certainly not taught in American high schools.

Yet they hold the key to true financial independence – Financial Peace – if you will, and finally escaping the debt cycle that holds so many families hostage.

What is the Dave Ramsey Approach to Debt Elimination?

When working with me as your Financial Coach we will work through the “7 Baby Steps” outlined in Dave Ramsey’s book “The Total Money Makeover.”

These steps are:

Step #1 – Put $1,000 in a beginner emergency fund. The emergency fund is for use on – get this – emergencies only. I will teach out strategies on how to save this amount very quickly so that we can get on to Step #2- the Debt Snowball.

Step #2 – Pay off debt using the debt snowball. This method of paying off debt is not complicated but is a powerful way to eliminate debt and energize you to achieve your financial goals.

Step #3 – Put 3-6 months of expenses into savings as a full emergency fund.

Step #4 – Invest 15% of your household income into ROTH IRAs and tax-favored retirement plans.

Step #5 – Save for your children’s college.

Step #6 – Pay off your home early.

Step #7 – Build wealth and give.

Learn more about the Baby Steps by clicking HERE.

What is a Certified Ramsey Solutions Master Financial Coach?

John Skiba is a licensed attorney with vast experience in consumer issues and is also certified by Ramsey Solutions as a Master Financial Coach.

Ramsey Solutions is associated with Dave Ramsey and certifies Financial Coaches who receive training and pass an examination focused on training financial coaches in the Dave Ramsey approach to resolving debt and building wealth.

Schedule a Free Consultation!

John Skiba, Esq.

John Skiba, Esq.

We offer a free consultation to discuss your debt problem and help you put together a game plan to eliminate your debt once and for all. Give us a call at (480) 420-4028