SUED BY A DEBT COLLECTOR?

Check Out Our Online Video Courses That Will Take You Step-by-Step Through the Process of Drafting Your Own Documents.

These Courses are Designed to Assist Consumers No Matter What State You Live In!

Amazing. I have not had this explained to me this well, and I am a law school graduate. Thank you.

– Diana V. (Course review for How to Eliminate a Default Judgment).

Very clear and to the point. I wish I had this course earlier. This is extremely helpful. Everything is explained clearly and in detail. Thank you!

-Severino C. (Course review for How to Draft an Answer to a Debt Collection Lawsuit)

This course saved me literally thousands!! It was understandable and drafting the answer was laid out so it was easy to follow. Thank you!!!

– Rita G. (Course review for How to Draft an Answer to a Debt Collection Lawsuit)

This is a great way to answer a summons!! A+++

-Ken K. (Course review for How to Draft an Answer to a Debt Collection Lawsuit)

I hope people enroll in this course as early as possible. I found this course AFTER I had filed my answer… and now I see the errors I made.

-Brian A. (Course review for How to Draft an Answer to a Debt Collection Lawsuit)

Informative and easy to understand.

-Bonnie B. (Course review for How to Draft a Response to a Motion for Summary Judgment)

Learn How to draft an Answer in a Debt Collection Lawsuit

(including template/form)

Learn How to Draft a Response to a Motion for Summary Judgment

(including form/template)

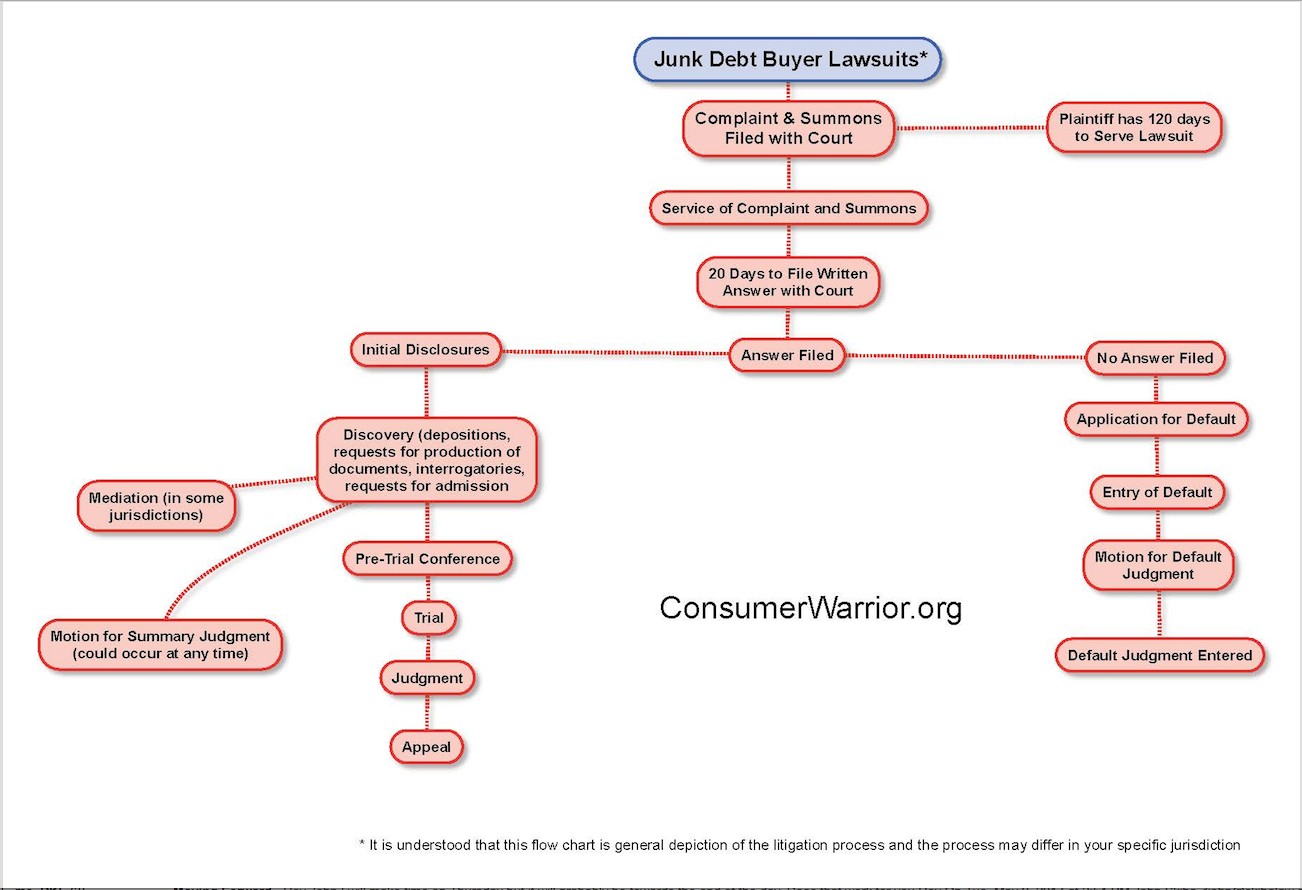

There are several junk debt collection agencies that are ready to take advantage of you through your previous debts. They generally buy charged-off debts from original creditors. The original creditors typically sell these old debts for pennies on the dollar to junk debt buyers who then file lawsuits against consumer with the hope of obtaining a judgment and then garnishing your wages. Those who are being sued by these third party debt collectors have rights that should be protected. If you are being sued by a debt collector, it may be possible for you to represent yourself without the assistance of a lawyer to fight these creditors.

The following courses demonstrate how to fight these junk debt collectors and save you the legal fees of hiring an attorney. They show you what you need to do to defend your rights and to take the right steps in fighting against the debt buyer. If a junk debt collector such as Midland Funding or any one of the 100s of third party junk debt collection agencies is harassing you, is suing you for multiple listing of the same debt, or is bullying you into paying a debt past the statute of limitations, learn how to represent yourself without going into bankruptcy. Purchase any of my courses to save thousands of dollars in lawyer fees.

NEED BANKRUPTCY INFORMATION?

Not Sure if Bankruptcy is the Right Option for You? Learn More About the Process With Our Online Bankruptcy Courses and Resources.

Hundreds of thousands of people across the United States file for bankruptcy every year. The decision to declare bankruptcy is a difficult one for people to make, as bankruptcy follows you around on your credit report for ten years after the fact. This makes it hard to get new lines of credit, to apply for some housing, or even to qualify for a few jobs. Bankruptcy, however, may be a good decision, depending on the amount of your debts and current state of your credit score. See if bankruptcy is right for you, understand the pros and cons of filing for bankruptcy, and determine if you should seek legal counsel by purchasing this course.

Schedule a Free Consultation!

John Skiba, Esq.

John Skiba, Esq.

We offer a free consultation to discuss your debt problem and help you put together a game plan to eliminate your debt once and for all. Give us a call at (480) 420-4028