Arizona's Premier Bankruptcy & Debt Defense Law Firm

Your Path to a Debt-Free Future starts here

Our Core Values

At the heart of our firm is a simple promise: we solve debt problems—with compassion, clear communication, and proven competence.

Compassion

We treat every client with dignity and respect.

Compassion

Compassion means we treat every client with dignity and respect, recognizing the human side of financial stress. We meet clients where they are, without judgment, and work to restore their peace of mind.

Communication

We speak clearly and keep clients informed.

Communication

Communication means we speak clearly, listen carefully, and keep clients informed every step of the way. We eliminate confusion, reduce anxiety, and ensure our clients always know where things stand.

Competence

We bring deep legal expertise to every matter.

Competence

Competence means we bring deep legal expertise, strategic thinking, and executional excellence to every matter. We don't guess. We act—decisively and effectively.

This is the standard we hold ourselves to. Every case. Every client. Every time.

Arizona's Trusted Choice: Thousands Helped, Millions in Debt Erased

When you're facing overwhelming debt, you need more than just legal representation—you need a partner who understands your situation and has the proven track record to help you succeed. At Arizona Consumer Law Group, we've helped thousands of Arizonans regain their financial freedom, erasing millions of dollars in debt along the way.

What sets us apart? Our commitment to excellence isn't just a promise—it's demonstrated in every case we handle. We combine deep legal expertise with genuine compassion, ensuring you receive personalized attention and strategic solutions tailored to your unique circumstances. Our team doesn't just file paperwork; we fight for your future.

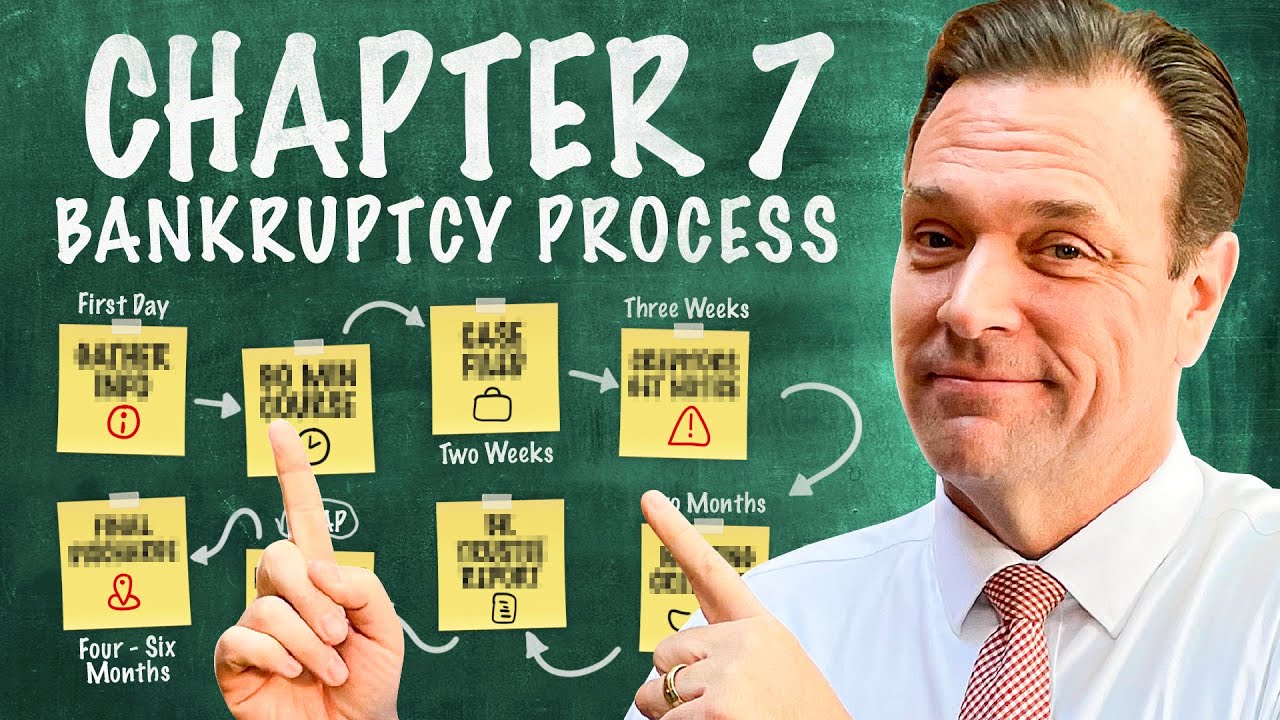

Want to learn more about how we can help you? Visit our YouTube channel where we share valuable insights, answer common questions, and provide expert guidance on bankruptcy and debt defense. Our videos break down complex legal concepts into clear, actionable information—because knowledge is power when facing financial challenges.

Learn More About Us

Watch our videos to discover how we can help you achieve financial freedom