When the bankruptcy code was amended back in 2005 one of the new requirements was that those wishing to file for bankruptcy would need to take a pre-bankruptcy credit counseling course as well as a post-filing financial management course.

When the bankruptcy code was amended back in 2005 one of the new requirements was that those wishing to file for bankruptcy would need to take a pre-bankruptcy credit counseling course as well as a post-filing financial management course.

Pre-Bankruptcy Credit Counseling Course

Often before people come and visit with me after they have done all they can to avoid a bankruptcy filing. Many times this includes participating in some sort of credit counseling or debt management course. These classes serve their purpose but will not satisfy the requirement that you attend a credit counseling course prior to your bankruptcy filing.

The course must be approved specifically for those people needing to file for bankruptcy. In my office I use a company called DECAF (Debtor Education and Certification Foundation). You are able to complete this course online and it only takes an hour or two. The course must be taken within 180 days before your bankruptcy is filed with the court.

The course itself is nothing to stress out over. It will walk you through your current financial situation and give you budgeting tips and ideas. The answers you provide during the course do not come to me or the bankruptcy court. In fact, the certificate that I receive to file with the bankruptcy court upon your completion of the course simply indicates that you completed the course and provides the date it was completed.

Post-Filing Financial Management Course

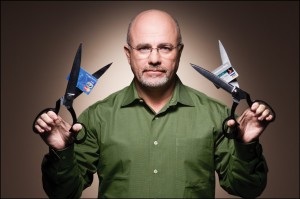

After you case is filed with the bankruptcy court you will be required to complete a financial management course before the bankruptcy court will grant you a discharge of your debts. In my office this can be done online or by watching a DVD. I currently use Dave Ramsey as my provided for the post-filing course. If you have read any of Dave Ramsey’s books or listen to his radio show you know that he is not only informative but entertaining. I have received a lot of positive feedback from this course from clients.

In sum, there are two course requirements that are required in order to get your discharge in your bankruptcy case. Both are relatively short – couple of hours – and there is actually some good information in both of them.

If you need to file bankruptcy I would be happy to meet with you to evaluate your situation and discuss what options are out there. My bankruptcy consultations are always free. I can be reached at (480) 420-4028 or via email at john@skibalaw.com .

Schedule a Free Consultation!

John Skiba, Esq.

John Skiba, Esq.

We offer a free consultation to discuss your debt problem and help you put together a game plan to eliminate your debt once and for all. Give us a call at (480) 420-4028