50 pages. The typical consumer bankruptcy has about 45 to 60 pages of information that is filed with the bankruptcy court. Income, debts, assets, transactions, expenses – they all must be disclosed in your bankruptcy documents. If you file for bankruptcy you are going to be required to sign off on your documents no less than six times – and all of those signatures are written under penalty of perjury.

50 pages. The typical consumer bankruptcy has about 45 to 60 pages of information that is filed with the bankruptcy court. Income, debts, assets, transactions, expenses – they all must be disclosed in your bankruptcy documents. If you file for bankruptcy you are going to be required to sign off on your documents no less than six times – and all of those signatures are written under penalty of perjury.

With such a heavy penalty associated with your signature, it is vital that you fully understand what it is your are signing.

And because of this, I am embarking on a series of articles that will discuss, page-by-page, what is included in your bankruptcy documents and what you are required to disclose.

So, let’s begin with the document that starts it all – your bankruptcy petition.

The Bankruptcy Petition

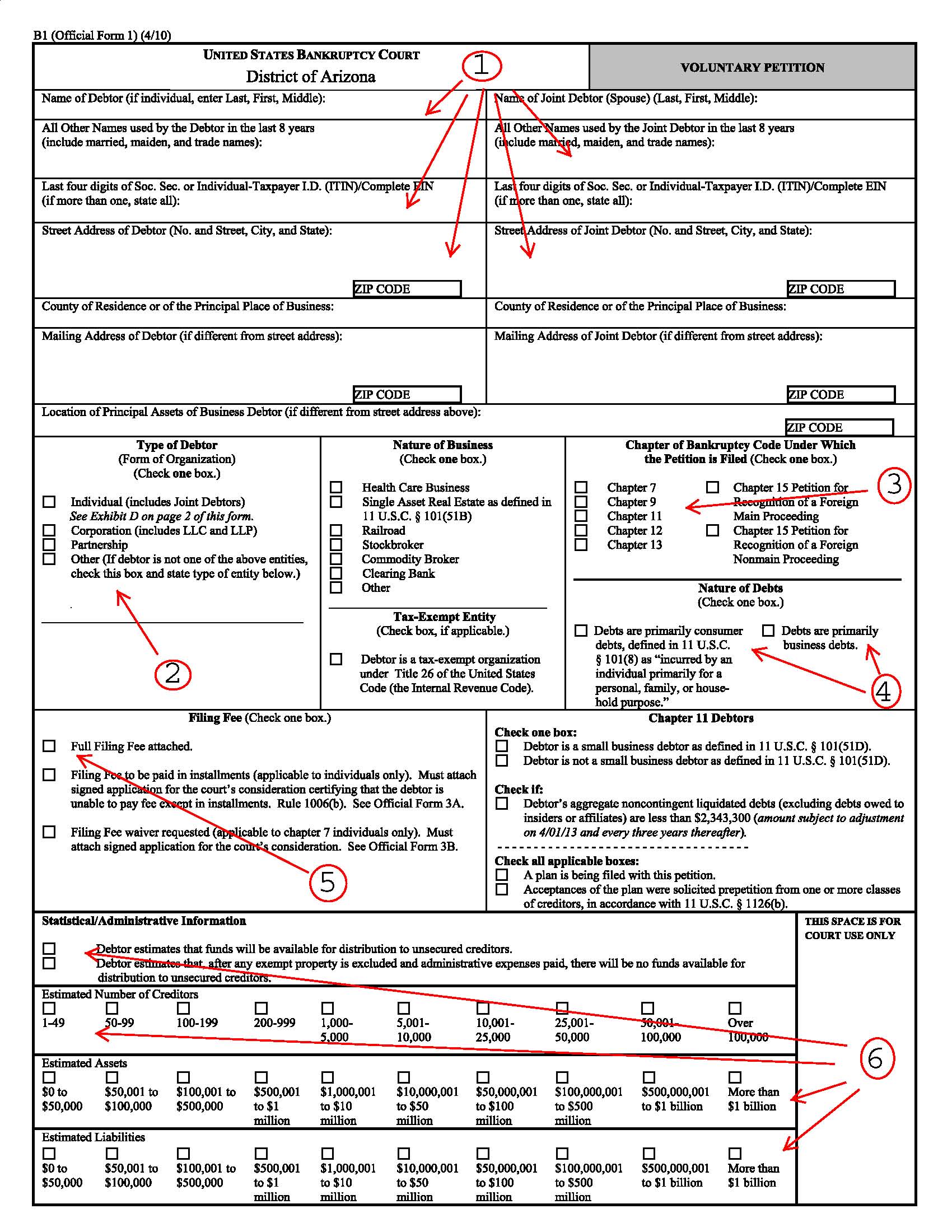

Three of the most power-packed pages you may ever encounter. The Petition is the the first document that is filed with the bankruptcy court and begins your journey through the bankruptcy process. Here is what page one of the bankruptcy petition looks like:

1. Contact Information

The first thing you need to provide the court is your name, address, and social security number. Your full name is required as well as any other names you may have used – and by other names I mean married or maiden names, not nicknames (i.e. no P. Diddy, Puff, Puffy or any others).

It is very important that the bankruptcy court have a good mailing address for you. The bankruptcy court will communicate with you through the mail. If it doesn’t have the correct mailing address you may miss something that could end up costing you big time. If you move during or after your bankruptcy you need to let the court know.

2. Type of Debtor

In the bankruptcy world you are known as the “Debtor”. In this section you need to let the court know if you are an individual or a business (hint, if you are filing for yourself, you are an individual:).

3. Chapter of Bankruptcy

In this section you need to let the court know what chapter of the bankruptcy code you are filing under. For most individuals this will be either chapter 7 or chapter 13.

4. Nature of Debts

In this section you are required to let the bankruptcy court know if your debts are primarily consumer or primarily business related. This is important because if your debts are primarily business related the bankruptcy means test is not applicable. This means that you may be able to qualify for a chapter 7 bankruptcy even if your income exceeds the allowed limits.

So what does “primarily” mean? If more than half your debts are due to a business (including personal guarantees on business debts) than you would check off the business debts box. However, be careful. Don’t forget to include your mortgage in your calculations. The debt on your home is typically not a business debt and may keep you from getting over that 50% mark.

5. Filing Fee

Here you need to check the box as to how you are going to pay the filing fee charged by the bankruptcy court. Your options are to pay in full, ask the court to allow you to make a few payments, or ask the court to waive the filing fee altogether.

6. Statistics

In this area the court keeps some general statistics on estimated number of creditors, assets, and debts. The forms provide for over $1 billion dollars in debt. The reason being, is this is the same form that corporations use if they need to file bankruptcy as well…and I guess if you have more than a billion dollars in debt you could check the box there as well!

That is the end of page one. We are one-third of the way done with completing the bankruptcy petition…let’s look at page two.

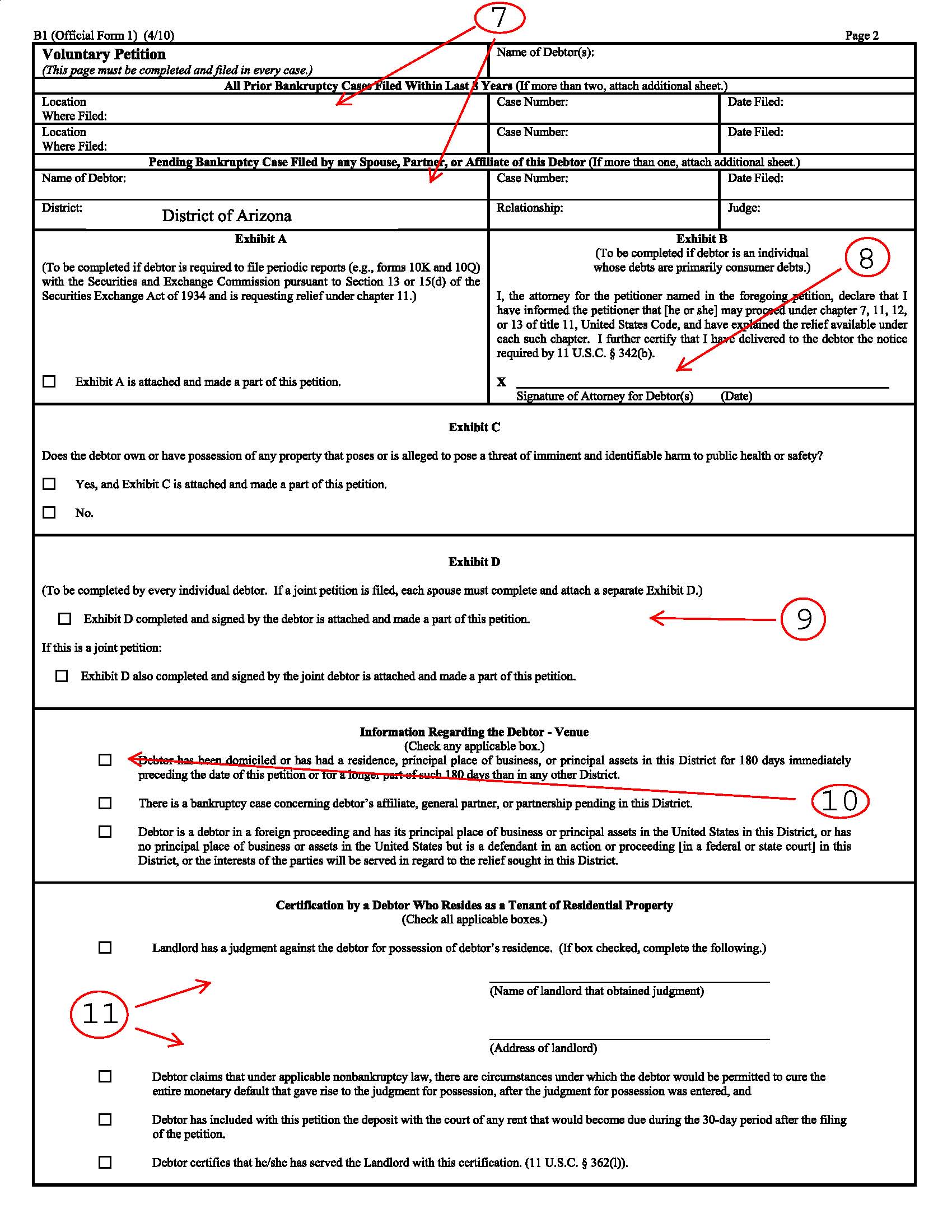

7. Prior or Pending Bankruptcy Cases

Here you need to disclose any prior bankruptcy you have filed within the last 8 years. Notice it says “filed” and not “completed” or “discharged”. Even if you filed a bankruptcy that was dismissed or otherwise unsuccessful you need to disclose where you filed it, the case number, and the date filed.

Also, if you have a spouse that currently has a separate pending bankruptcy case it needs to be disclosed here.

8. Exhibit B

If most of your debts are consumer debts as discussed above, and you are represented by an attorney, your attorney must sign off in this area attesting that he/she has informed their client there are different types of bankruptcy and further that they have provided you with certain notices required by the bankruptcy code.

9. Exhibit D – Credit Counseling

Prior to the filing of your bankruptcy case you are going to be required to complete a credit counseling course. Exhibit D requires that you check off that it is completed at some point within the last 180 days and attached a copy of the certificate you received from the course.

10. How Long Have You Lived in Your State?

In this section you are required to disclose to the court If you have lived in your state for the better part of the last 180 days. This means that if you have lived in Arizona for more than 91 days, you can file your bankruptcy case here. If you haven’t lived here for 91 days, you would be required to file your case in the state you most recently came from.

11. Certification Regarding Your Rental Property

If you rent your home and you are behind on your rent, or if your landlord has obtained an eviction judgment against you, you need to check the box that applies to your situation.

One more page to go…

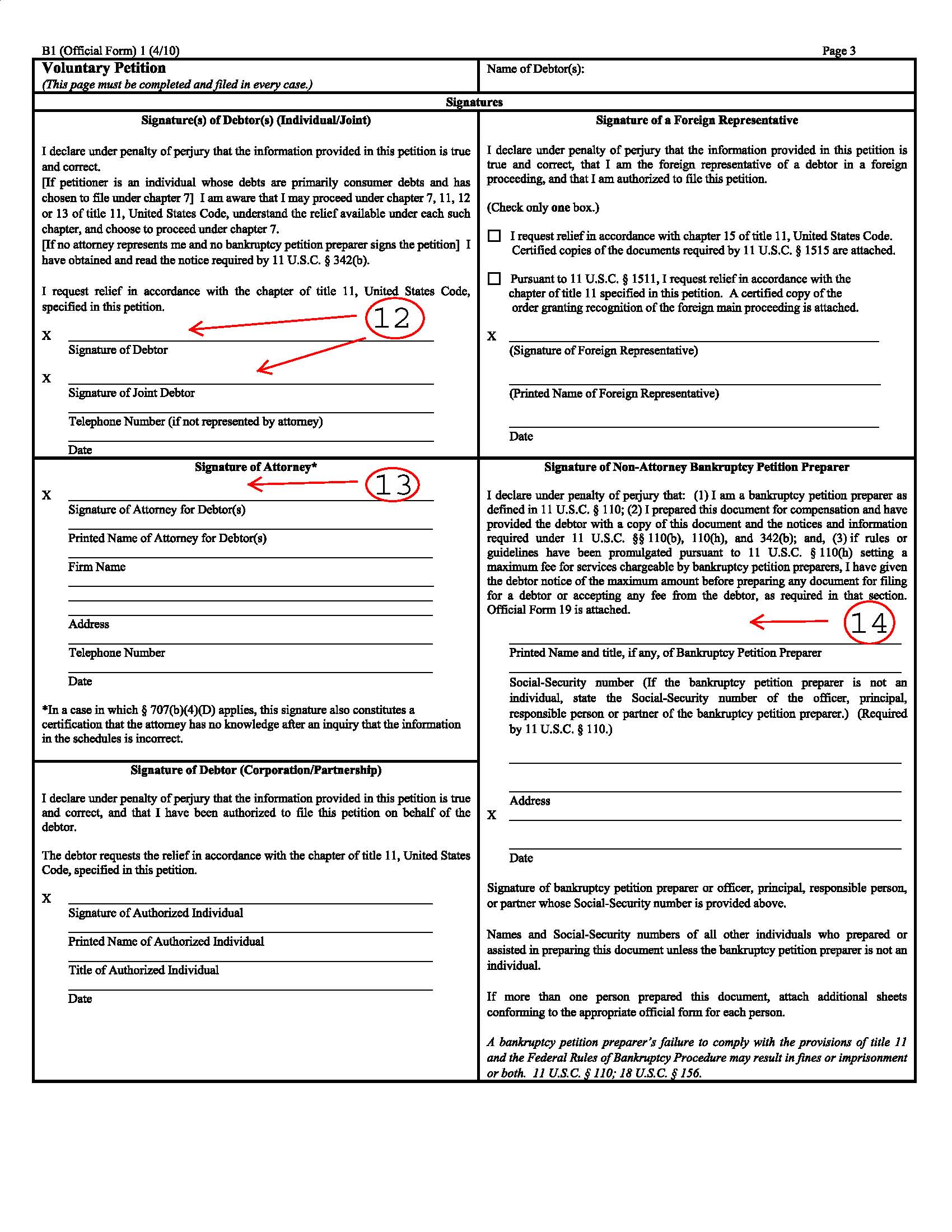

12. Signatures

Now you have to sign off on all the prior information you have provided the bankruptcy court in the first two pages of the petition. In this section you are stating under penalty of perjury that the information provided in the petition is true and correct. Further, you have to attest that you are aware that there are other types of bankruptcy available and that you are choosing to proceed under chapter 7 (or whatever chapter you are filing).

It is a big deal when you sign this. Make sure you are providing accurate information to the court. If you intentionally withhold information it could end up costing you big time.

13. Bankruptcy Attorney’s Signature

If you have hired an attorney – which I highly recommend you do – your attorney must sign off in this section. Something kind of interesting here, if you look below the signature block there is a sentence that states that your bankruptcy lawyer has no knowledge that any of the information in the schedules is incorrect.

In essence, you bankruptcy attorney is vouching for you. Telling the court that the information you are providing to the bankruptcy court is correct. Your attorney can be liable for your misrepresentations. Make sure you disclose all of your assets (and everything else) to the court. And for heaven’s sake, don’t ask your attorney to help you hide or fail to disclose something. It’s not going to happen.

14. Signature of Document Preparer

If you used a document preparer instead of an attorney (bad idea) for your bankruptcy filing they must sign off on the document as well.

So, that is the bankruptcy petition. While there are many more pages to come, you can actually just file the petition if you are in a hurry or if your house is up for foreclosure. Once the petition is filed the bankruptcy court will issue an order called the Automatic Stay that will stop all collection efforts against you, including wage garnishments and foreclosure sales.

You will then be given about two weeks to get all of the remaining information filed with the court.

In the next article we are going to tackle the real meat of the bankruptcy filing – the Schedules.

Schedule a Free Consultation!

John Skiba, Esq.

John Skiba, Esq.

We offer a free consultation to discuss your debt problem and help you put together a game plan to eliminate your debt once and for all. Give us a call at (480) 420-4028