Arizona’s justice court system has a problem when it comes to mediation in debt buyer cases brought by junk debt buyers like Portfolio Recovery Associates, CACH, Cavalry SPV, and Midland Funding.

Before I jump into the mediation problem faced by Arizona consumers it might be helpful to discuss what mediation is and how it works in Arizona’s justice courts.

What is Mediation in Debt Collection Cases?

Mediation is the process where the justice court appoints an independent mediator to meet withe the parties to a lawsuit and see if there is some middle-ground that can be reached. The goal of mediation is settlement – which means that you as the defendant agree to pay an amount to the junk debt buyer that is less than the amount they are alleging is owed.

Not all of the Arizona justice courts require mediation. In fact only handful do. Mediation is ordered in most collection lawsuits in the Desert Ridge Justice Court (Phoenix), the Dreamy Draw Justice Court (Phoenix), and the University Lakes Justice Court.

How Will I know If My Debt Collection Case Will be Submitted to the Mediation Process

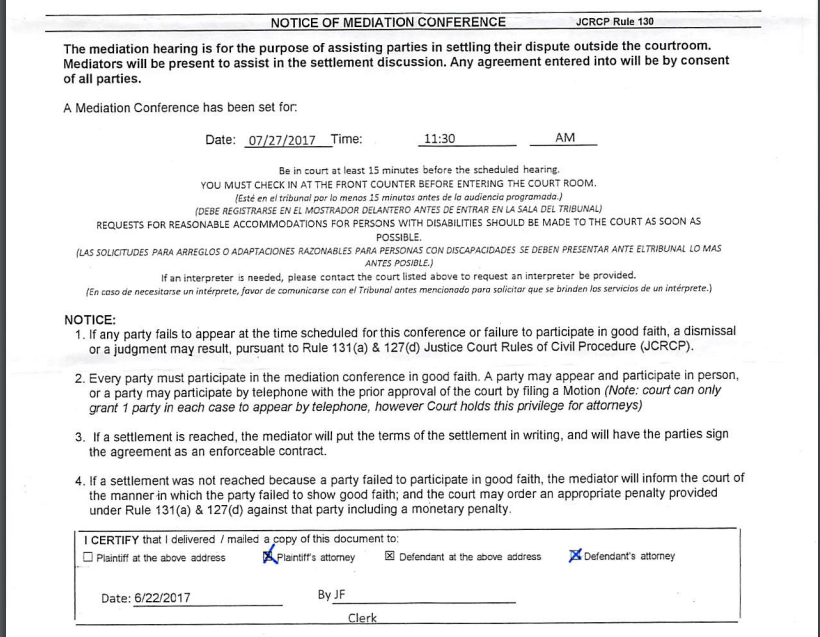

If the court is going to require you to go through the mediation process you will receive written notice from the Court giving you the date, time, and location of the mediation.

The typical notice of mediation from an Arizona Justice Court will look something like this:

As indicated in the above Notice the court requires the parties and their attorneys to appear and participate in good faith. Once you appear at the mediation you will be assigned to a conference room where the assigned mediator will then discuss the rules of the mediation and start the mediation/negotiation process to see if middle ground can be reached.

If settlement is reached the parties will sign an agreement and the case will then be over.

If a settlement is not reached then the mediator will let the court know and the court will then set a trial date – often sent to you later on in writing.

So What’s the Problem?

There is nothing wrong with parties to a law suit participating in the mediation process. In many instances the mediation process will resolve the case and save both sides money and the aggravation of litigation.

What’s wrong with mediation in Arizona’s Justice Courts?

The problems stems from the approach that justice courts allow junk debt buyers like CACH, Midland Funding, Portfolio Recovery and others, to take when it comes to mediation.

Once a Notice of Mediation Conference is received by the parties the attorneys who represent the junk debut buyers often file two motions with the court.

First, the debt buyer’s attorney will ask that they, as the attorney, be permitted to participate on behalf of their debt buyer client and that the debt buyer’ presence be waived. Basically they are asking the court to excuse the debt buyer from having to actually come to the mediation and participate.

Second, they file a motion with the court to get permission for their attorney to participate in the mediation over the phone.

And here is the real problem…THE COURTS GRANT THEIR MOTIONS!

Why do I think this is outrageous? Because by giving the plaintiff / debt collector a pass from having to actually show up at the mediation and further by permitting their attorney to appear over the phone – and at the same time requiring you and your attorney to appear in person with your attorney at the mediation – the court has created an unequal ground for negotiations before the first offer is even presented.

For settlement to occur and mediation to be successful each party will need to be giving up something as part of the process. A saying lawyers are fond of is that the hallmark of a good settlement is that neither party is happy.

For settlement to occur and mediation to be successful each party will need to be giving up something as part of the process. A saying lawyers are fond of is that the hallmark of a good settlement is that neither party is happy.

However if you, as the consumer, must take the time off of work and you and your lawyer take the time to drive down to the court house and participate in the mediation, yet the junk debt buyer doesn’t have to show and its attorney is permitted to do nothing more then pick up the phone and call in, then you can see how the consumer is at a disadvantage from the beginning.

The Parties Must Appear and Participate in Good Faith

If the debt buyers aren’t even required to show up and participate how can it be said that they are participating in good faith?

Not only that, but often in settlement discussions it is not so much the legal issues or even the factual issues that result in a settlement but often it is something unexpected that one of the parties says or an issue is raised that wasn’t previously thought of that results in one or both of the parties giving up more than they might have thought they would when the mediation began.

If Arizona Justice Courts excuse their presence then the likelihood of a fair settlement is much less likely.

Debt Buyer Attorneys Don’t Have Incentive to Settle for Lower Amounts

When Arizona justice courts allow a junk debt buyer to appear through their attorney and their attorney alone the likelihood that the consumer is going to get a fair deal diminishes greatly.

A junk debt buyer – who often paid less then 5 cents on the dollar for the debt is it suing on – might be willing to take a reasonable settlement just to get the case resolved.

However if the junk debt buyer’s attorney is the only person deciding whether to settle or not they will have less incentive to settle for a lower amount. The reason being is that most debt collection attorneys are paid on a contingency – meaning that they get a percentage of any amount they collect from the consumer.

So while the debt buyer may be willing to take a lesser amount, the debt buyer’ attorney is going to want to settle for as much as possible because the higher the settlement the higher the legal fee for the lawyer.

The Justice Courts Need to Level the Playing Field

So what is the solution?

Justice Courts need to stop allowing debt buyers to appear through their attorneys and stop allow telephonic appearances by their attorneys. Or, in the alternative they need to allow the consumer’s attorney to appear on their behalf and allow all parties to appear over the telephone.

My guess is that most court’s would find the latter proposal to be somewhat ridiculous – but that is my point. If the parties are supposed to be on equal footing before the court, then what’s good for the junk debt buyer is good for the consumer.

Schedule a Free Consultation!

John Skiba, Esq.

John Skiba, Esq.

We offer a free consultation to discuss your debt problem and help you put together a game plan to eliminate your debt once and for all. Give us a call at (480) 420-4028