****Updated**** Arizona Legislature Recently Amended this Statute – Doubling the Time from Five to Ten Years

Over 95% of the cases filed by junk debt buyers like Midland Funding, CACH, LLC, and Portfolio Recovery Associates end in a default judgment. These debt collectors file thousands of debt collection lawsuits in Arizona each year so it is easy to see that there are literally thousands of Arizona families dealing with a judgment from a junk debt buyer.

A question I often get from clients who are dealing with a default judgment is how long the judgment is enforceable? (i.e. how long am I at risk for wage garnishment, bank levy, etc.).

In Arizona it is pretty straightforward – judgments are good for ten (10) years from the date of its entry by the Clerk of the Court.

However, junk debt buyers can renew their judgment every ten (10) years for the rest of your life. But the law requires that the creditor take certain steps in order to renew the judgment, and if the appropriate steps are not taken then the judgment will go away forever.

Arizona Judgments are Enforceable for at Least Ten Years

If you have a judgment or even a default judgment entered against you the creditor can try and collect on this judgment for at least ten (10) years. The ten years starts running from the when the Clerk of the Court enters in the judgment. This is important to understand because the date the Clerk of the Court enters the judgment can (and often is) different from the date the judge signed the judgment.

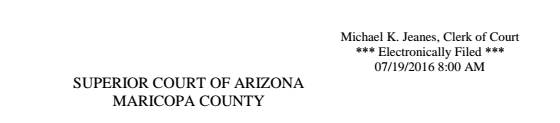

For example, a judge in the Maricopa County Superior Court may sign of on a judgment on July 17, 2016, but the Clerk of the Court may not “enter” the judgment until July 19, 2016. If you have a judgment out of the Maricopa County Superior Court you can find out what day the Clerk of the Court entered the judgment by looking in the upper right hand corner of the document. You should see something that looks like this:

In this example, the Clerk of the Court, Michael K. Jeanes, entered the judgment on “07/19/2016 8:00 AM”.

Now that we know the judgment was “entered” on July 19, 2016, we know that we start calculating the ten (10) year period from July 19th, not the day the judge actually signed the judgment. In this example the judgment would be enforceable until July 19, 2026.

Note for Arizona Justice Court Judgments – Most of the justice courts in Maricopa County, Arizona do not have a separate stamp on the judgment and thus you should use the date the judge signed your judgment as the starting point in your calculations.

Arizona Judgments Can Be Renewed After Ten Years

If you have a judgment against you that is older than ten (5) years, you need to determine if the judgment is still valid. Judgment creditors are required to renew the judgment after ten years and do so by filing an affidavit with the court that issued the judgment against you.

This affidavit can be filed no earlier than ninety (90) days prior to the day the judgment was entered by the Clerk of the Court. Using our example above, if the deadline to renew the judgment is set for July 19, 2026, the judgment creditor must file an affidavit of renewal with the court no earlier than April 19, 2026 (approximately ninety days prior to the July 19th deadline).

If a creditor files their renewal affidavit more than ninety (90) days prior to the expiration date, or if they file the renewal affidavit after the deadline has expired, then it will not be considered timely and the judgment will no longer be considered a valid judgment that a debt collector can collect on.

What All of This Means for You

Living with an outstanding judgment can be stressful. There is always the chance that the creditor is lurking out there somewhere waiting to garnish your wages or take money out of your checking account.

If you know for sure how long a creditor has to collect on its judgment, you can have some peace of mind that either the judgment is no longer valid and you don’t need to worry about wage garnishment, or, if the judgment is still good you know that you need to take action to either get it vacated, settled, or discharged in bankruptcy.

I have found over the years that the biggest form of stress in most people’s lives that are dealing with debt problems is not knowing what is around the next corner. Armed with the knowledge of what your creditors can, and can’t do helps you to understand your options and make the best decision possible to deal with your debt problems once and for all.

Do You Need Help with Your Debt Problem?

If you need assistance in figuring out your options and what steps would be appropriate to resolve your debt problem give me a call at (480) 420-4028 or email me at john@skibalaw.com.

Schedule a Free Consultation!

John Skiba, Esq.

John Skiba, Esq.

We offer a free consultation to discuss your debt problem and help you put together a game plan to eliminate your debt once and for all. Give us a call at (480) 420-4028